We know that many of you are hungry for data to help you keep up with current media industry trends and prepare for changes that are just around the corner. To help you do just that, we compile excerpts from some of the key stories covering issues affecting the publishing and media industries each month.

This month’s selections cover a range of topics, including stats on web, Internet, online video, and smartphone use, as well as data on Amazon, Barnes & Noble, and the New York Times Co.

The Web at 25 in the U.S. (Pew Research Internet Project)

The Web at 25 in the U.S. (Pew Research Internet Project)

- 87% of American adults now use the Internet, with near-saturation usage among those living in households earning $75,000 or more (99%), young adults ages 18-29 (97%), and those with college degrees (97%).

- Fully 68% of adults connect to the Internet with mobile devices like smartphones or tablet computers.

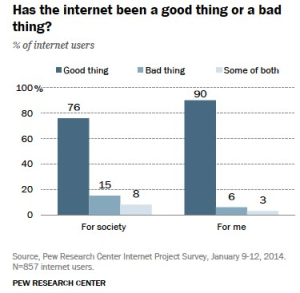

- 90% of Internet users say the Internet has been a good thing for them personally, and only 6% say it has been a bad thing, while 3% volunteer that it has been some of both.

- 76% of Internet users say the Internet has been a good thing for society, while 15% say it has been a bad thing and 8% say it has been equally good and bad.

- 53% of Internet users say the Internet would be, at minimum, “very hard” to give up, compared with 38% in 2006.

NAA: ‘Print Only’ Still More Than Half of Newspaper Audience, Even as Digital Grows (Poynter)

- More than half of newspaper audience—54% as measured by Scarborough research in 150 large markets—still read their local paper’s news reports only in print.

- Total daily circulation was up 3% and Sunday circulation was up 1.6% year-to-year among 541 daily papers reporting results to the Association of Audited Media (AAM) for the six-month periods ending Sept. 30, 2013 and September 30, 2012.

- The daily circulation gains were entirely driven by digital gains at the largest newspapers. Sunday gains also reflected the heavy use of “Sunday Select” products—packets of inserts to non-subscribers—by larger papers. At the great majority of newspaper organizations reported digital audience did not offset print circulation losses.

- Print circulation continues to decline as a share of total circulation—now 71.2% daily and 74.9% Sunday. A year earlier, print was 85% of the daily total. That is to say that the industry—especially the largest papers—is using changed AAM rules to substitute digital audience for print.

As Barnes & Noble Nook Revenues Slide 50%, the Company Says It’s Launching Another Tablet (Gigaom)

- Nook revenues were $157 million for the third quarter, down 50.4% from a year ago.

- Overall, B&N saw a small profit—$63.2 million, compared to a loss of $3.68 million last year—but revenues were down 10.3%, to $2 billion.

- Retail store revenues were down 6.3%, to $1.4 billion, and college store sales were down 6%, to $486 million.

- The company laid off or lost 190 Nook employees during the quarter—26% of the Nook team.

- Barnes & Noble broke out Nook’s losses by segment: Device and accessories sales were $100 million for the quarter, down 58.2% from a year ago “due to lower unit selling volume and lower average selling prices.”

- Digital content sales were $57 million, down 26.5% from last year.

Amazon vs. Book Publishers, by the Numbers (Forbes)

- $5.25 billion: Amazon’s current annual revenue from book sales, according to one of New Yorker staff writer George Packer’s sources. That means books account for 7% of the company’s $75 billion in total yearly revenue.

- 19.5%: The proportion of all books sold in the U.S. that are Kindle titles. E-books now make up around 30% of all book sales, and Amazon has a 65% share within that category, with Apple and Barnes & Noble accounting for most of the balance.

- 53%: The effective discount Amazon receives from Random House on its books.

- >50%: The decrease in the number of independent bookstores over the past 20 years.

- <10%: The proportion of books now sold through independent bookstores.

- 14: The number of workers Amazon employs for every $10 million in revenue it generates. For brick-and-mortar retailers, the average is 47 employees per $10 million of revenue.

With Newsstand Decline, Magazine Circulation Falls Slightly (Capital)

- Total average circulation for U.S. consumer magazines was relatively flat in the second half of 2013 compared to the same period a year earlier, according to data released by the Alliance for Audited Media.

- Total circulation was down 1.7%.

- Newsstand sales decreased 11.1 % for the 386 magazines measured, and paid subscriptions declined 1.2 %.

- Digital editions increased by 36.7%, but they still accounted for just 3.5% of total circulation, up from 2.4% in 2012 when 289 magazines reported 7.9 million digital replica editions.

The State of Online Video (EContent Magazine)

- In September 2013 alone, nearly 189 million Americans—87% of U.S. Internet users—viewed 46 billion online videos, the average length of which was 5.1 minutes, comScore reports.

- One hundred hours of video are uploaded every minute to YouTube. And consumer Internet video traffic globally will comprise 69% of all consumer Internet traffic by 2017, up from 57% tallied in 2012, according to Cisco.

- ComScore reveals that in September, 22.9 million video ads were viewed by U.S. Internet users—representing one-third of all videos seen online and 3.5% of all minutes spent watching video online.

- eMarketer estimates that U.S. digital video ad spending will nearly double in just three years, increasing from $4.14 billion in 2013 to $8.04 billion in 2016.

MagNet Industry Insights 2013 Newsstand Sales Results (Magazine Information Network)

- The newsstand magazine business is still a viable $3.1 billion dollar business, and we sell over 12 million copies per week to consumers. But, over the last several months, we have seen signs that the continual sales decline has impacted the financial viability of all wholesalers, with three companies closing their doors and another attempting to restructure to remain in business.

- Unfortunately, the decline of the non-weekly titles sales accelerated during 2013. As has been the case for the last five years, the overall sales decline is mainly driven by the top 50 titles and titles ranked below 1,000 in sales. The top fifty titles were down 10.6% in dollars compared to last year’s numbers.

- Some major publishers who aggressively promoted low-price subscription offers saw their newsstand sales affected dramatically. Bauer, AMI, and Time Inc. sales were all impacted by the continual decline in celebrity title sales.

Study Reports 20% of Overall Traffic Comes From Facebook and Pinterest (Search Engine Journal)

- A new report released by Shareaholic, a content discovery and sharing platform used by more than 200,000 websites, revealed that Facebook and Pinterest collectively referred one-fifth of all visitors to sites across the web in January.

- Facebook drove more than 15% of that overall visits that sites received.

- Pinterest’s share was surprisingly close to 5%.

- The pair, together, drove more than 20% of overall visits to sites.

The Biggest Facebook Publishers of January 2014 (Newswhip)

- BuzzFeed further consolidated its top position on Facebook in January, with over 9.5 million shares of content published that month and over 17.6 million likes. Their most impressive stat is the number of comments their output attracted last month—over 13 million.

- The Huffington Post had an increase of over 2 million shares, while Fox News saw a 1 million lift in their total likes. It’s hard to point to the exact reasons for these rises, but recent tweaks to Facebook’s timeline, which sees ‘suggested articles’ pop up whenever you click on a story, may be a factor.

- Another big story has been the phenomenal success of Viral Nova. The site ranked third overall in our top Facebook publishers chart for January—ahead of the likes of CNN, The New York Times, and even Upworthy.

- One notable absence from January’s top 10 is Upworthy. In fact, their total Facebook interactions almost halved, from 10,771,244 to 5,697,857. They ended January in 11th place.

iPad Dominates Business Tablet Usage (Good E-Reader)

- Contrary to the oft-held belief that the iPad is more suited for entertainment than anything else, the iPad accounted for 91.4% of all enterprise tablet activations in Q4 2013, according to enterprise software vendor Good Technology.

- The financial sector has emerged the single largest user of iPads, accounting for a comprehensive 46.8% of all activations. Next comes the business and professional services sector, which accounts for 13.8% of iPad activations.

- In contrast, smartphones and tablet devices running Google’s Android OS make up 26% of the enterprise segment. Samsung is leading the charge here, accounting for 56% of device usage, according to a survey by Fiberlink Communications.

Emerging Nations Embrace Internet, Mobile Technology (Pew Research Global Attitudes Project)

- In a remarkably short period of time, the Internet and mobile technology have become a part of everyday life for some in the emerging and developing world, according to a face-to-face survey of 24,263 people in 24 emerging and developing economies from March 2, 2013 to May 1, 2013.

- In 14 of 24 nations, at least half of 18-to-29-year-olds say they are online.

- Internet use is also correlated with national income, as richer nations tend to have a higher percentage of Internet users.

- Similarly, smartphone ownership is more common in countries with higher levels of per-capita income. Education is also associated with smartphone ownership.

- A median of only one-in-four cellphone users across the countries surveyed say they access a social networking site regularly on their phone.

- A median of 16% get political news and information through their cellphones. However, there are certain countries and regions where using cell phones to get political and other information is more widespread, such as Venezuela (39%) and China (31%).

New York Times Digital Subscriptions Grew 19% in 2013 (Poynter)

- The number of digital subscriptions to New York Times Co. products grew from 640,000 at the end of 2012 to 760,000 at the end of 2013, a gain of nearly 19%.

- Revenue from circulation was up about 4% over the previous year, the company’s year-end earnings report says.

- Print advertising revenue was down 7% for the year, and digital advertising fell a little more than 4% over 2012. Over all, advertising revenue was down a little more than 6%.

- Other revenue, which the company says includes “news services/syndication, digital archives, rental income and conferences/events,” dropped 2.5%.

- In the fourth quarter of 2013, circulation revenue was down about 4% and ad revenue was down about 6%.

Media Metrics is a new monthly feature from Technology for Publishing, aimed at keeping you armed with the latest industry data. If you’d like to share something you’ve read, drop us a note. And keep up with the latest industry news coverage by signing up for our This Week in Publishing emails or our monthly Publishing Trends newsletter.

Posted by: Margot Knorr Mancini