Holiday device activations, media M&A activity, mobile ad spending, top communication tools, and more are covered in this month’s installment of TFP’s Media Metrics roundup.

To help you keep up with trends and prepare for changes just around the corner, each month we compile excerpts from some key reports covering issues affecting the publishing and media industries. Here are our top picks.

Phablets Performed Fabulously on Christmas (eMarketer)

- A report from analytics firm Flurry showed that Apple by far had the largest share of new devices activated during the week of Christmas (51%), followed by Samsung (18%), Nokia (6%), Sony (1.6%), and LG (1.4%).

- During the same period, activations of large smartphones, or so-called phablets, jumped 225% compared with last year, to 13% of total activations.

- In contrast, activation of tablets dropped 35%, the report said.

- Activations of medium-size phones fell 1 percentage point but still made up the largest share of total activations for the period.

Media M&A Soars in 2014 (Folio)

- Investment bank JEGI reported that media merger and acquisition activity jumped significantly in 2014, with deals valuing more than $128 billion. That figure reflects a 92% increase over the previous year.

- Across the media industry, there were 1,481 acquisitions, a 6% increase over 2013.

- However, the report noted a slight decline in the magazine sector in terms of volume and value of M&A activity, with 31 deals estimated at $1.6 billion.

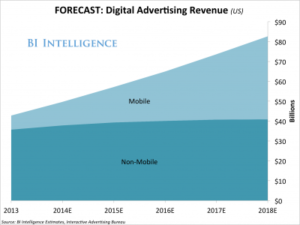

Display and Video Will Finally Push a Huge Rise in Mobile Ad Spending (Business Insider)

- A BI Intelligence report projected that mobile ad spending in the U.S. will reach nearly $42 billion in 2018. That reflects a five-year compound annual growth rate (CAGR) of 43% from 2013.

- During that same period, mobile display and mobile video advertising revenue will skyrocket, with a projected CAGR of 96% and 73%, respectively. However, search and social media will continue to make up the largest share of mobile ad revenue in the U.S. over those five years.

- The report also noted that mobile programmatic advertising will make up 43% of mobile display ad revenue in the U.S. by 2018.

Email Remains Dominant Technology for Work; ‘Social’ Is an Also-Ran (Media Daily News)

- According to a Pew Research Center study, email tops the list of tools that are “very important” to workers overall, followed by the Internet (54%), landline phones (35%), mobile phones (24%), and social networking sites such as Facebook, LinkedIn, and Twitter (4%).

- Contrary to popular belief, use of landline phones is predominant among non-office-based workers (31%), followed by use of mobile phones (28%), the Internet (26%), email (25%), and social sites (2%).

- However, excluding non-office-based workers, the study found that 78% of respondents see email as the most important communication tool, followed by the Internet (68%), landline phones (37%), mobile phones (22%), and social sites (7%).

- About half of the study participants said digital media changed the way they work, including the number of people they have contact with (51%) and the hours in their workweek (35%).

Rival Social Networks Gain Users, but Facebook Captures More Attention (The Wall Street Journal)

- A study by the Pew Research Center found 23% of U.S. adults surveyed in August 2014 use Twitter, up from 18% in 2013, and 26% of respondents use Instagram, up from 17%. Facebook use, meanwhile, remained flat, at 71%.

- But the study found Facebook had higher user engagement, with 70% of users logging in daily, up from 63% over the previous year.

- In contrast, engagement with Twitter fell, with only 36% of Twitter users logging in daily, down from 46% the year before. Daily engagement with Instagram was flat, at 49%.

After Solid First Half, Ad Spending Slows (Media Life Magazine)

- Kantar Media reported that ad spending in the U.S. increased just 0.3% in the third quarter of 2014, to $33.7 billion. That compares with a growth rate of 5.7% in the first quarter, boosted by the Winter Olympics, followed by 0.7% in the second quarter. Q4 figures, which are expected to be higher due to political ad spending, will be out in March.

- The report projected the growth rate for ad spending in 2015 at nearly 4%.

- Television was the only sector to see gains in the third quarter, with spending up 6.5%, including a significant jump for Spanish-language TV (23.7%), as well as cable TV (7.9%), and spot TV (5.2%).

- Other sectors saw declines in the same period: magazines (4.9%), newspapers (13%), and radio (5.3%).

The 2014 Association Publishing Survey (Folio)

- A survey found associations expect to bring in publishing revenue of $30 per member in 2014. That figure is down $2.25 from three-year levels and $8.32 from the five-year average.

- Print advertising made up 54.7% of all revenue for association publishers, a decline from 58% over the past five years.

- Digital media also was down slightly, from a five-year average of 8.9% to 8.3% of total revenue in 2013. However, associations said they expect digital to jump to 9.3% of total publishing earnings for 2014.

65% of Facebook’s Video Views Are Now on Mobile Devices (Adweek)

- Some 65% of global Facebook video views are via mobile devices, the social media company said.

- It also reported that video posts per Facebook user are up 94% in the U.S. and 75% globally.

- Globally, consumer and marketing clips in the newsfeed have increased 3.6 times over the past year.

- More than half of the U.S. users who use Facebook daily view at least one video, the company said.

ComScore: Holiday Desktop Spend $53.3B (NetNewsCheck)

- ComScore reported record desktop holiday spending (Nov.-Dec. 2014) of $53.3 billion, an increase of 15% over the same period the previous year.

- For the fifth year in a row, the biggest day for online buying via desktops was Cyber Monday, which brought in more than $2 billion.

- The day after Cyber Monday took the second-place spot for the most desktop holiday spending, at $1.796 billion. Retailers also took in $1.615 billion on Dec. 8, also known as Green Monday, and $1.505 billion on Black Friday.

- The report said desktop spending topped $1 billion for 15 individual days during the holiday period, up from 10 days the year before.

Mobile Got Traffic, But Desktop Gets Online Sales (The Center for Media Research)

- Still more holiday results: An IBM Digital Analytics Benchmark report said shoppers using mobile devices contributed to an 8% increase in online sales on Christmas Day.

- Mobile purchases jumped 20% in 2014 and made up 35% of total sales.

- Although accounting for only 43% of online traffic on Christmas, desktops were used for nearly two-thirds of online sales that day.

- The report also said that iOS devices were used for 27% of online sales, while the percentage of online sales via Android devices was only 8%.

Forecast: Streaming Will Surpass Trad Pay TV (Media Daily News)

- A study by Netherlands-based Irdeto predicted that only 18% of U.S. television viewers will watch TV movies and sports on pay TV six years from now.

- By 2020, the research shows 27% of U.S. consumers overall expect to do most of their TV viewing via services such as Netflix and Amazon Prime.

- Some 40% of 18- to 34-year-old viewers said they will mostly use Internet TV services six years from now.

- However, of those who said they will still be pay TV consumers in 2020, 56% in the U.S. cited better user experience while 32% cited more content availability.

Poll Reveals Pessimism About Viewability In 2015 Among Digital Media & Ad Execs (Marketing Land)

- A recent poll of digital media and advertising executives found 60% believe viewability will be the biggest industry challenge this year.

- Of those respondents, 65% said they are pessimistic that digital publishers will achieve high viewability rates by the end of 2015, the report said.

- One area of optimism is efforts to fight ad fraud, with more than half of the executives expecting a decrease given new technologies and more focus on the issue. Only 26% said it is a pressing challenge for the industry.

- In terms of programmatic advertising, 80% of the survey respondents said it is beneficial for the industry, but the same number “strongly” believe that programmatic still has issues that need to be ironed out.

Can Mobile Print Media, News Sites Satisfy the Need for Speed? (eMarketer)

- According to research by The Search Agency, 40% of the print news and media sites studied served dedicated mobile versions, 30% used responsive web design (RWD), and 22% served dynamic mobile sites.

- However, while only 8% served desktop versions of their sites, none of the study participants could meet Google’s recommendation for a 5-second load time.

- The report showed average load times as follows: 67.4 seconds for dedicated mobile, 99.8 seconds for RWD, 110.3 seconds for dynamic mobile, and 162.0 seconds for desktop.

- Further, only 56% of media sites provided social sharing buttons on their homepage.

Media Metrics is a monthly feature from Technology for Publishing, aimed at keeping you armed with the latest industry data. If you’d like to share something you’ve read, drop us a note. And keep up with the latest industry news coverage by signing up for our This Week in Publishing emails or our monthly Publishing Trends newsletter.

Posted by: Margot Knorr Mancini